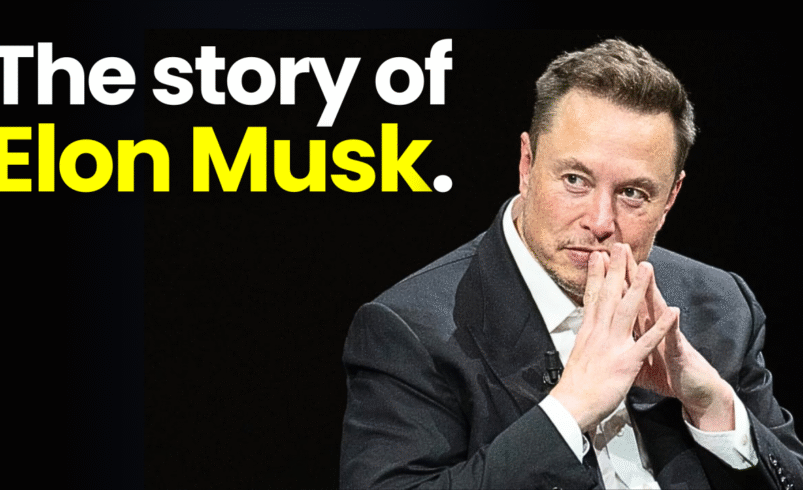

When it comes to modern innovators, few names spark as much admiration, curiosity, and controversy as Elon Musk. From electric cars to rockets, brain–computer interfaces to tunnels under cities, Musk’s ventures read like a science-fiction story — except they’re real. This is the story of a man who refuses to accept the limits of today and relentlessly builds the future of tomorrow.

Early Life: A Curious Mind in South Africa

Elon Reeve Musk was born on June 28, 1971, in Pretoria, South Africa, to Maye Musk, a model and dietitian, and Errol Musk, an engineer. From a young age, Elon exhibited an insatiable curiosity. By the age of 10, he had taught himself programming and, by 12, he sold a video game called Blastar for $500. While other kids were playing outside, Elon was diving into physics, computers, and books about space and science.

His childhood, however, wasn’t without challenges. Elon faced bullying at school and a sometimes tense home environment. Yet, these hardships seemed to fuel his determination. He once said, “When something is important enough, you do it even if the odds are not in your favor.”

Education and Early Ventures

Elon Musk left South Africa at 17, partly to avoid mandatory military service, and moved to Canada, enrolling at Queen’s University. He later transferred to the University of Pennsylvania, where he earned dual degrees in Physics and Economics. These fields would later converge in his entrepreneurial ventures: physics for understanding rockets and technology, and economics for building companies.

Musk’s first serious business venture was Zip2 Corporation in 1995, a software company providing online city guides. In 1999, Compaq acquired Zip2 for nearly $300 million, giving Elon his first taste of major success. Not long after, he founded X.com, which became PayPal, sold to eBay for $1.5 billion in 2002. Musk’s knack for identifying emerging technologies was becoming clear.

SpaceX: Reaching for the Stars

Perhaps Musk’s most audacious goal is to make humanity multiplanetary. In 2002, he founded Space Exploration Technologies Corp., or SpaceX. The company’s mission: reduce the cost of space travel and eventually colonize Mars.

SpaceX achieved multiple firsts:

- First privately funded rocket to reach orbit (Falcon 1)

- First private spacecraft to dock with the International Space Station

- Development of reusable rockets, dramatically reducing costs

Today, Starship represents Musk’s vision for Mars colonization. SpaceX has also revolutionized satellite internet with Starlink, aiming to provide global connectivity even in the most remote areas.

Tesla: Driving the Electric Revolution

Musk’s impact on transportation is equally transformative. In 2004, he joined Tesla Motors, then a fledgling electric car startup. Under his leadership as CEO and product architect, Tesla revolutionized electric vehicles (EVs) with cars like the Model S, Model 3, Model X, and Model Y.

Tesla didn’t just build cars; it shifted global perceptions about EVs, proving that sustainability and luxury could coexist. Musk’s insistence on vertical integration — producing batteries, motors, and software in-house — gave Tesla a competitive edge.

Beyond Cars and Rockets: Neuralink, SolarCity, and The Boring Company

Elon Musk’s curiosity knows no bounds:

- SolarCity (2006): Focused on solar energy and sustainable power solutions, now integrated with Tesla’s energy products.

- Neuralink (2016): Pioneering brain–computer interfaces to help humans interact with machines and potentially treat neurological disorders.

- The Boring Company (2016): Conceptualized to reduce traffic congestion by creating underground transportation tunnels.

Each venture addresses different aspects of humanity’s future, from energy sustainability to urban mobility to merging humans with AI.

Twitter/X and Media Influence

In 2022, Musk acquired Twitter, rebranded it as X, and made headlines worldwide. His vision was to transform it into an “everything app” — a platform for communication, finance, and more. While controversial, the move highlighted Musk’s willingness to take massive risks, regardless of public opinion.

Personal Life and Philosophy

Elon Musk’s personal life is as fascinating as his career. He has seven children, experienced high-profile relationships, and is known for his intense work ethic — often clocking 80–100 hours per week. Musk’s philosophy blends risk-taking, first-principles thinking, and relentless curiosity. He often says, “Failure is an option here. If things are not failing, you are not innovating enough.”

Awards, Achievements, and Influence

- Frequently ranked as the richest person in the world

- Revolutionized the automotive, aerospace, and energy industries

- Inspires millions to dream bigger, think differently, and challenge conventions

Musk’s story is not just about wealth or technology; it’s about vision, resilience, and the pursuit of ideas that change humanity.

Legacy: A Man Ahead of His Time

Elon Musk’s life demonstrates that dreams don’t have limits. From reusable rockets to electric cars and AI, he is shaping the future in ways few dare to imagine. Love him or criticize him, Musk remains a figure whose impact will resonate for generations.